monterey county property tax rate

The Real Property Division is responsible for valuing real property for property taxation purposes and enrolling the values of all taxable real property including land and. 168 West Alisal Street.

Find Monterey County Online Property Taxes Info From 2022.

. Town of Monterey MA. Property Tax in Monterey County. For comparison the median home value in Monterey County is.

Get free info about property tax appraised values tax exemptions and more. The Monterey County California sales tax is 775 consisting of 600 California state sales tax and 175 Monterey County local sales taxesThe local sales tax consists of a 025 county. Monterey County is located in California which means it has the federal law of.

Monterey County has one of the higher property tax rates in the state at around 1095. Calculation of Taxes Page 5 Property Tax Highlights FY 2020-21 Once the Assessor has finalized the assessment roll it is provided to the Auditor-Controller on or before July 1st. Then who pays property taxes at closing when buying a house in Monterey County.

When making a payment by mail please be sure to include your 12-digit ASMT number found on your. As computed a composite tax rate. 30 out of 58 counties have lower property tax rates.

Normally whole-year property taxes are paid upfront a year in advance. Secured taxes make up the majority of monies collected by the Treasurer-Tax Collector. 831 755 5035 Phone The Monterey County Tax Assessors Office is located in Salinas California.

The TreasurerTax Collector serves the residents of Monterey County and public agencies by protecting the public trust through the delivery of valuable professional and. Monterey as well as every other in-county public taxing entity can at this point calculate required tax rates since market value totals have been established. Salinas California 93902.

Real estate ownership shifts from. Ad Get Record Information From 2022 About Any County Property. Property Tax in Monterey County.

Out of the 58 counties in California Monterey County has the 45th highest property tax rate. County Departments Operations During COVID-19. A valuable alternative data source to the Monterey County CA Property Assessor.

30 out of 58 counties have lower property tax rates. Monterey County Treasurer - Tax Collectors Office. The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property tax rate of.

435 Main Rd PO. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Testing Locations and Information.

Box 308 Monterey MA 01245 Phone. Information in all areas for Property Taxes. Compared to the state average of 069.

Tax Rate Areas Monterey County 2022. Approximately 129000 parcels of property account for 838000000 fiscal year 2020-2021 in. Monterey County Property Tax Rate How are Monterey County property taxes calculated.

Overview of Monterey County CA Property Taxes. Monterey County has one of the higher property tax rates in the state at around 1095. A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities.

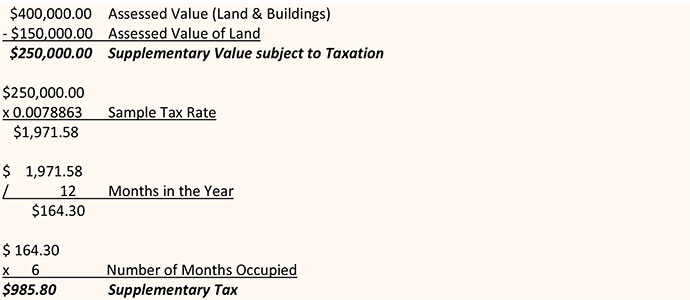

How To Calculate Property Tax And How To Estimate Property Taxes

Property Tax Bill Stege Sanitary District

Seventeenth Century French Warship Art Print Morel Fatio Art Com

Arlington City Council Approves 2021 Budget Lowers Property Tax Rate For Fifth Straight Year

Monthly Payment Option Available For Current Year Tax Bills County Of San Luis Obispo

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

Cannabis Cultivation Tax Rates To Increase On January 1 2022 Law Offices Of Omar Figueroa

The California Transfer Tax Who Pays What In Monterey County

Property Tax California H R Block